ny highway use tax return instructions

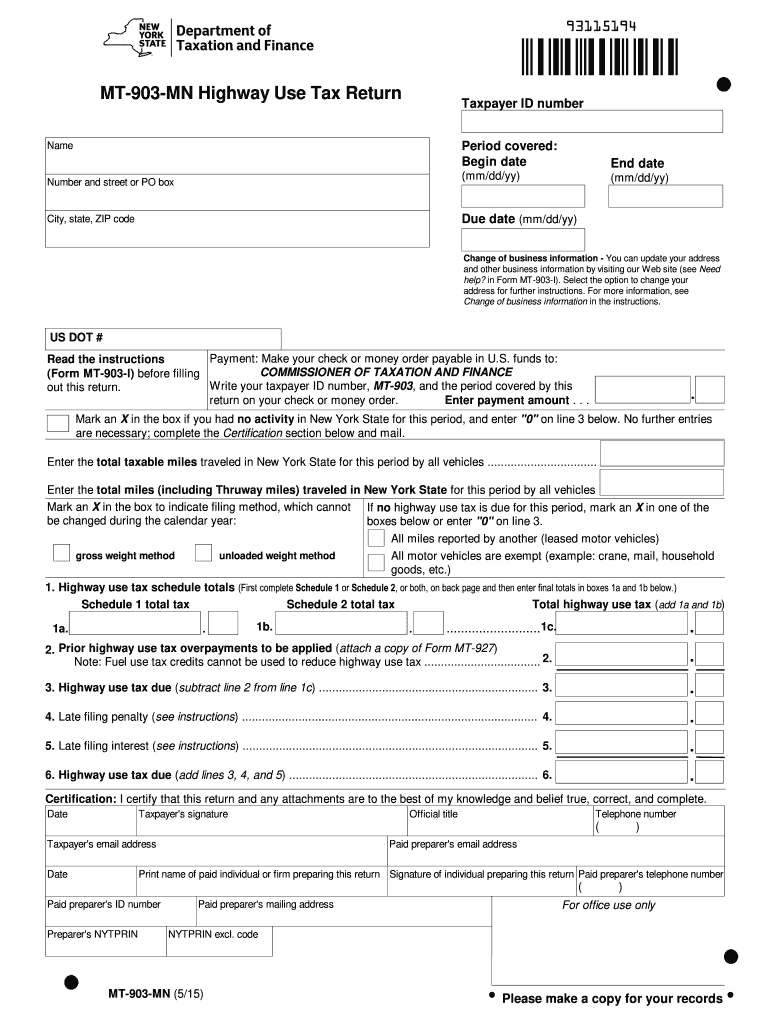

New York State highway use tax return visit our Web site at wwwnystaxgov. Miles including New York State Thruway miles traveled in New York State for this period by all vehicles.

61 Pa Code Chapter 31 Imposition

IFTA-21 Fill-in IFTA-21-I Instructions New.

. Use Form DTF-406 to request a refund of the highway use tax for. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b. You must file Form 2290 and Schedule 1 for the tax period beginning on July 1 2022 and ending on June 30 2023 if a taxable highway motor vehicle defined later is.

The bulletins provide information to help motor carriers operating in new york state comply with their highway use tax obligations. When completing your first return for the calendar year you must choose to use either the gross weight method or the unlo See more. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due.

At wwwtaxnygov or call 518 457-5431. Use Form 2290 to. Figure and pay the tax.

Highway Use Tax Web File You can only access this application through your Online Services account. Highway usefuel use tax IFTA Form number Instructions Form title. Figure and pay the tax due on highway motor.

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you choose to report the tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more.

If you are receiving this message you have either attempted to use a bookmark. Ny Highway Use Tax Return Instructions. Start completing the fillable fields and.

Figure and pay the tax. 22 rows Highway usefuel use tax IFTA Form number Instructions Form title. Download Or Email MT-903-I More Fillable Forms Register and Subscribe Now.

Do not report mileage traveled on the toll-paid. Use Form DTF-406 to request a refund of the highway use tax for. Instructions for form 2290 heavy highway vehicle use tax return 0719 06152020 inst 2290.

If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both. Make sure this address shows through envelope window ΠNYS TAX DEPARTMENT RPC - HUT PO. Claim for Highway Use Tax HUT Refund.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

New York Highway Use Tax Ny Hut 888 669 4383

Sales Taxes In The United States Wikipedia

Voter Voting Information Seneca County New York

Sales Taxes In The United States Wikipedia

Form St 101 Fillable New York State And Local Annual Sales And Use Tax Return Due Date Friday March 20 2015 See The Prior Year Sales Tax Forms Pageif You Need 2013 2014 Forms

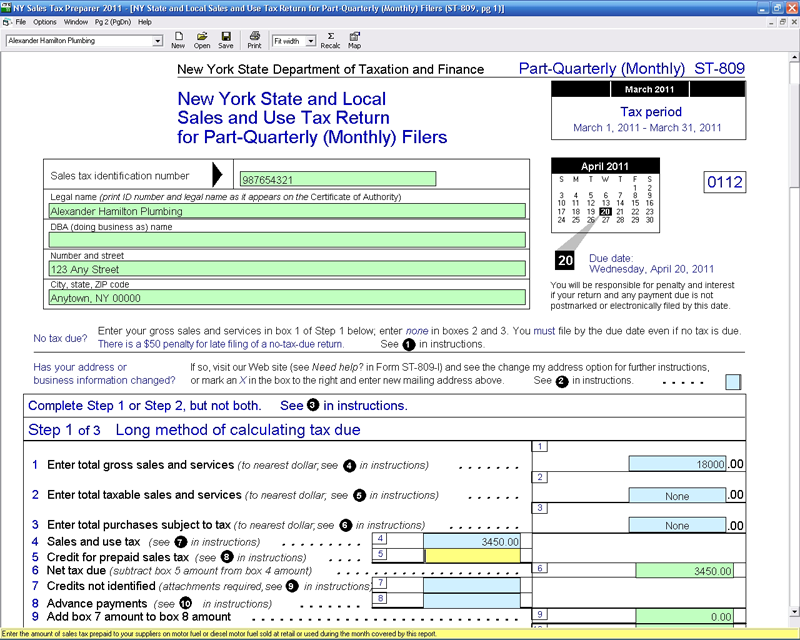

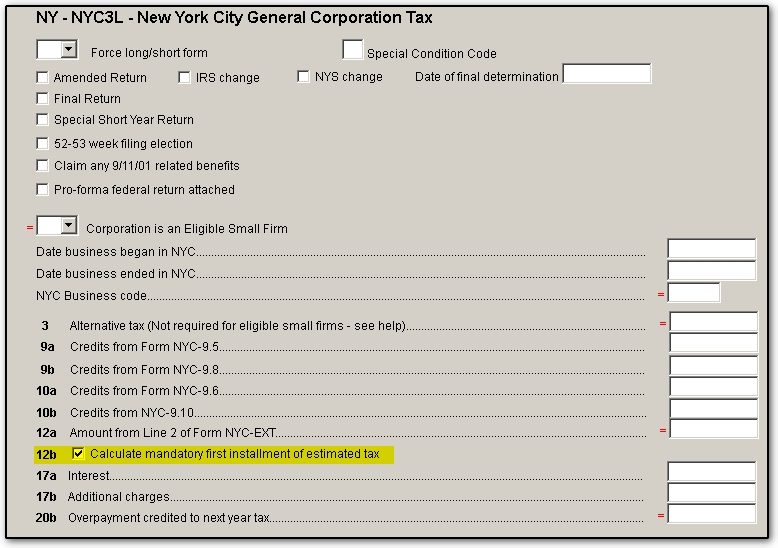

Ny Sales Tax Preparer Cfs Tax Software Inc Software For Tax Professionals

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Fill Free Fillable Forms For New York State

Exemptions Webster Ny Official Website

Sales Taxes In The United States Wikipedia

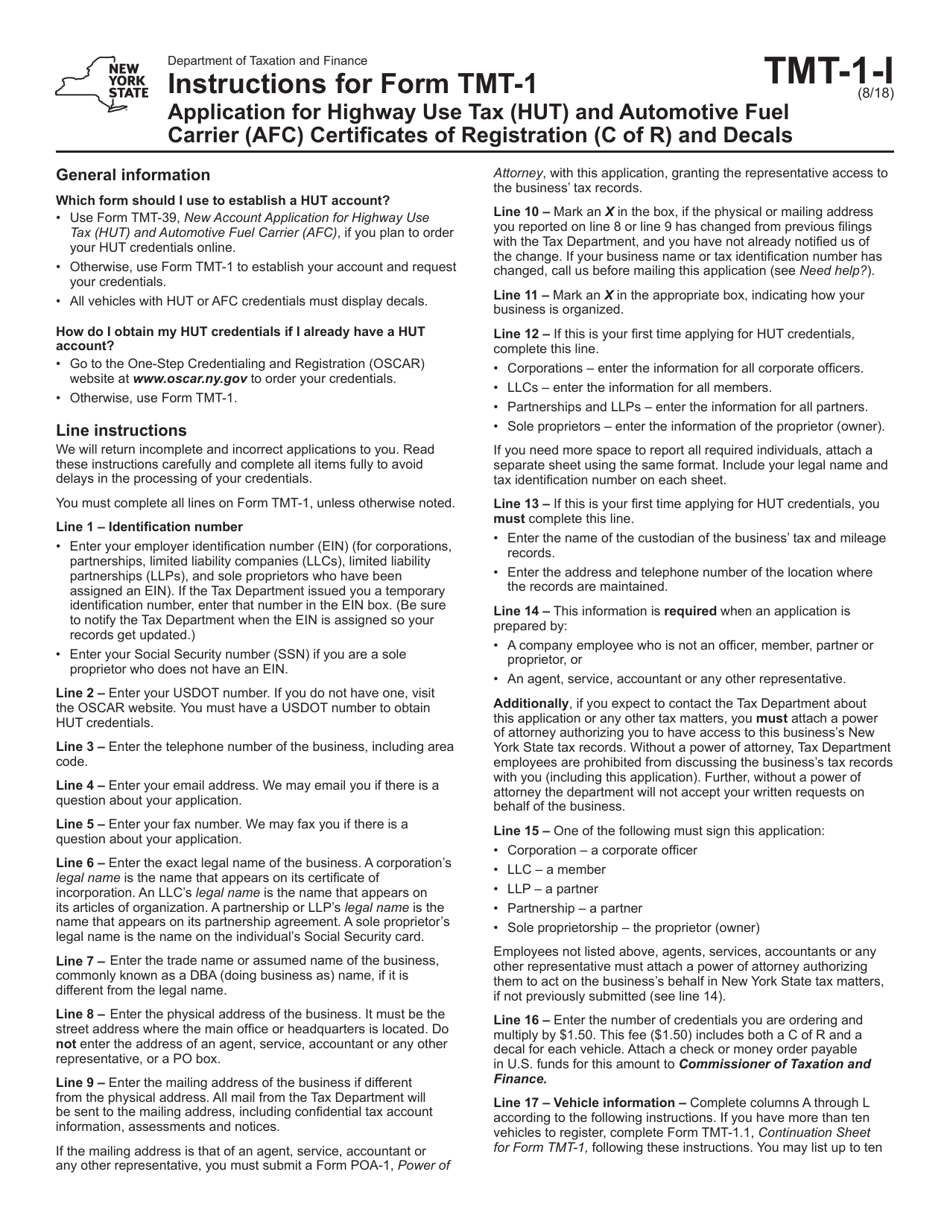

Download Instructions For Form Tmt 1 Application For Highway Use Tax Hut And Automotive Fuel Carrier Afc Certificates Of Registration C Of R And Decals Pdf Templateroller

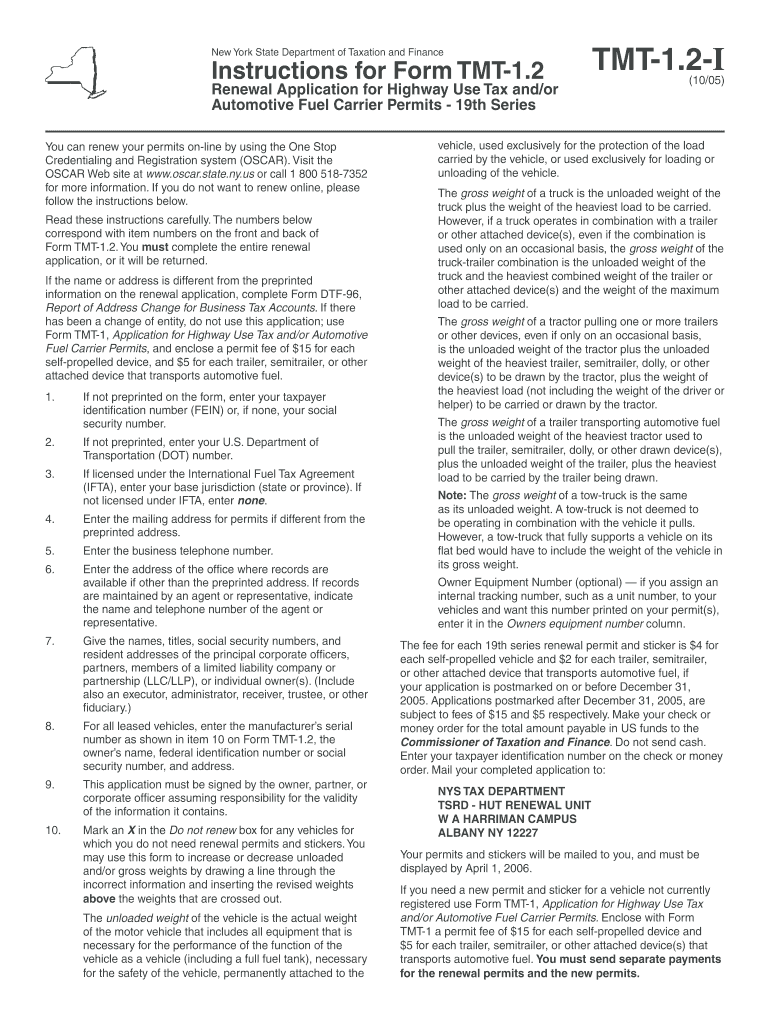

Ny Tmt 1 2 I 2005 2022 Fill Out Tax Template Online Us Legal Forms

Ny State And City Payment Frequently Asked Questions

2016 2022 Form Ny Tmt 1 Fill Online Printable Fillable Blank Pdffiller

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

How Much Does It Cost To Rent A Car Nextadvisor With Time

Ny Dtf Mt 903 Mn 2015 2022 Fill Out Tax Template Online Us Legal Forms